AVMetics’ ongoing independent AVM testing continues in 2019 according to the attached schedule. Please use the link below to download a pdf with the entire 2019 testing schedule.

The Wild, Wild West of Automated Valuations

Recently the OCC, FDIC and the Federal Reserve proposed raising the de minimis threshold for residential properties below which appraisals are not required to complete a home loan. Currently, most homes transacting at $250K and above require an appraisal, but Federal regulators propose to raise that level to $400K. A November 30th Wall Street Journal article raises some interesting issues about the topic. They reported that the number of appraisers is down 21% since the housing crisis, but more homes require an appraiser, since more and more homes exceed the threshold each year. The article also states that these factors open the door for cheaper, faster and “largely untested” property valuations based on computer algorithms, also known as Automated Valuation Models (AVMS).

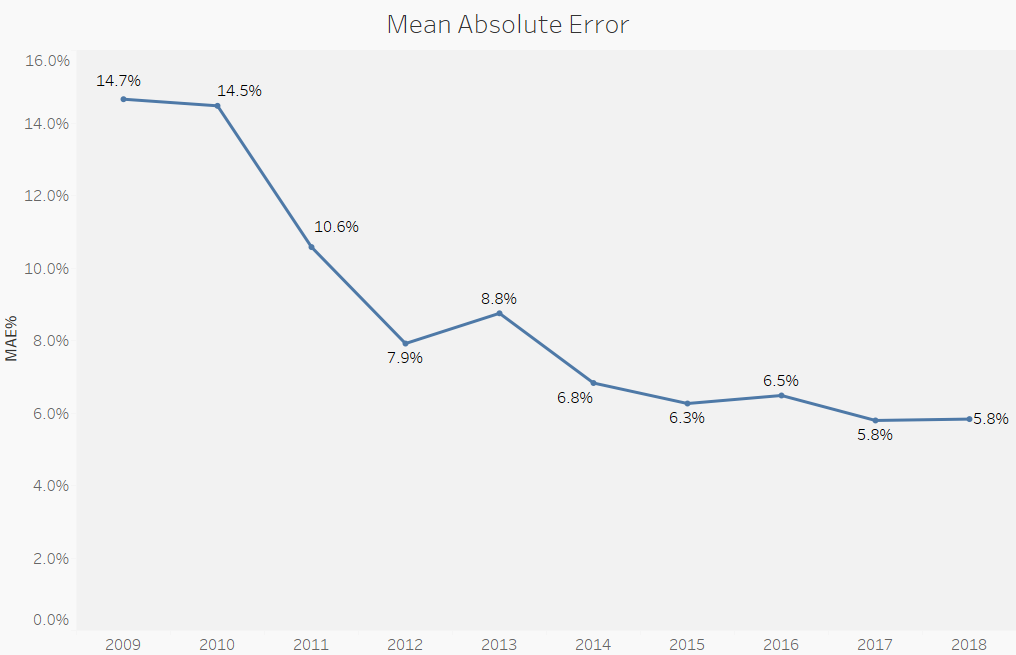

At AVMetrics, we have been continuously testing AVMs for over 15 years, so we’ve seen how they’ve performed over time. As an example, the accompanying chart shows model performance accuracy as measured by mean absolute error, a statistical metric of valuation error. We utilize many statistical measures of evaluating model accuracy and precision, and they all show significant improvement in AVMs over time. And, as these automated tools get better and the workforce of appraisers continues to shrink, the FFIEC members’ proposed change seems warranted, but that doesn’t mean they don’t have their critics.

Ratish Bansal of Appraisal Inc was quoted in The Journal describing the state of AVMs as “a wild, wild West,” inviting, “abuse of all kind.” Furthermore, he contrasts that with the voluminous regulatory standards covering the use of appraisals.

We note much of those voluminous standards represent nearly the same quality control that was in place before the Credit Crisis. In other words, appraisals are not a guarantee against collateral risk. They are simply one tool in the toolbox – an effective, but comparatively time consuming and expensive tool. Also of note, far from being the “wild, wild west,” AVMs are also governed by regulators, most notably, Appendix B of the Appraisal and Evaluation Guidelines (OOC 2010-42) and Model Risk Management guidance (OCC 2011-12). These regulatory guidelines require that AVM developers be qualified, users of AVMs use robust controls, incentives be appropriate, and models be tested regularly and thoroughly with out-of-sample benchmarks. They require documentation of risk assessments and stipulate that a Board of Directors must oversee the use of all models. In other words, if AVMs were the “the wild, wild west” they would be rooted in a town with oversight of the legendary Wyatt Earp.

My strong feeling is that appraisals should not be a sole and exclusive tool when evaluations can be effectively employed in appropriate, lower-risk scenarios. Appraisers are a valuable and limited resource, and they should be employed at (to use appraisal terminology) their highest and best use. Trying to be a “manual AVM” is not the highest and best use of a highly qualified appraiser. Their expertise should be focused on the qualitative aspects of property valuation such as the property condition and market and locational influences. They should also be focused on performing complex valuation assignments in non-homogeneous markets. AVMs do not capture and analyze the qualitative aspects of a property very well, and they still stumble in markets with highly diverse house stock or houses with less quantifiable attributes such as view properties.

However, several companies are developing ways of merging the robust data processing capabilities of an AVM with the qualitative assessment skills of appraisers. Today, these products typically use an AVM at their core and then satisfy additionally required evaluation criteria (physical property condition, market and location influences) with an additional service. For example, a lender can wrap a Property Condition Report (PCR) around the AVM and reconcile that data in support of a lending decision. This type of “Hybrid valuation” is on the track we’re headed down. Many companies have already created these types of products for commercial and proprietary use.

We at AVMetrics believe in using the right tool for the job, and we believe there is a place for automated valuations in prudent lending practices. We think the smarter approach would be to marginally raise the de minimis threshold, but simultaneously to provide additional guidance for considering other aspects of a lending decision, specifically, collateral considerations and eligibility criteria for appraisal exemptions such neighborhood homogeneity, property conformity, market conditions and more.